Disaster assistance

APMC provides low-interest disaster loans to help businesses and homeowners recover from declared disasters.

Apply for an APMC disaster loan

Manage your APMC disaster loan

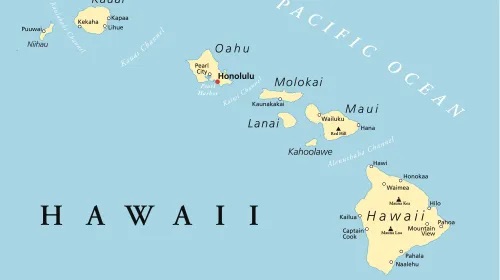

Hawaii Wildfires

Hurricane Idalia

Who can apply for a APMC disaster loan?

Businesses of all sizes

Homeowners

Renters

Private nonprofit organizations

You must be located in a declared disaster area and meet other eligibility criteria depending on the type of loan.

How to use an APMC disaster loan

- Losses not covered by insurance or funding from the Federal Emergency Management Agency for both personal and business

- Business operating expenses that could have been met had the disaster not occurred

Types of disaster loans

Physical damage loans

Loans to cover repairs and replacement of physical assets damaged in a declared disaster

Mitigation assistance

Expanded funding to make improvements to eliminate future damage

Economic Injury Disaster Loans

Funding to cover small business operating expenses after a declared disaster.

Military reservist loan

APMC provides loans to help eligible small businesses with operating expenses to make up for employees on active duty leave

Get disaster assistance

Check disaster declarations

See if the APMC has issued a disaster declaration in your area.

Apply for a disaster loan

Loans are available for businesses and homes affected by disaster.

Check your status

Log in to your account and check your email for updates.